Sherwin williams commercial credit application – Introducing the Sherwin-Williams Commercial Credit Application, a comprehensive financial solution tailored specifically for businesses seeking to streamline their paint and supplies purchases. This application offers a range of benefits and features designed to enhance cash flow, simplify procurement, and support business growth.

Within this guide, we will delve into the application process, eligibility criteria, credit review procedures, and key terms associated with the Sherwin-Williams Commercial Credit Application. Additionally, we will explore case studies and testimonials from businesses that have successfully leveraged this solution to optimize their operations.

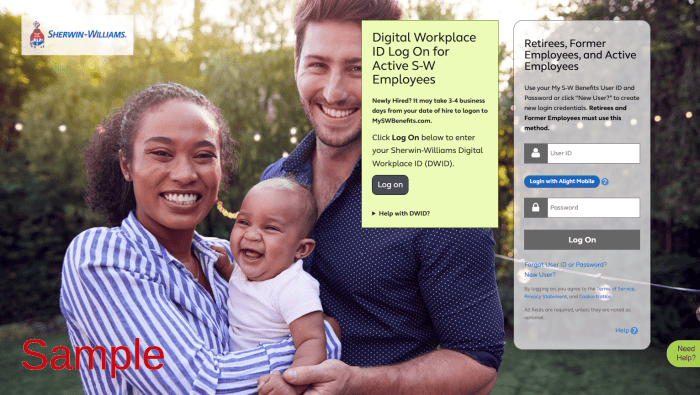

Overview of Sherwin-Williams Commercial Credit Application: Sherwin Williams Commercial Credit Application

The Sherwin-Williams Commercial Credit Application is a financing solution designed to provide businesses with convenient and flexible access to credit for their paint and supplies purchases. It offers numerous benefits, including:

- Streamlined purchasing process

- Exclusive discounts and promotions

- Extended payment terms

- Simplified billing and account management

To be eligible for the Sherwin-Williams Commercial Credit Application, businesses must meet certain criteria, such as:

- Established business with a positive credit history

- Annual revenue exceeding a specified threshold

- Regular paint and supplies purchases from Sherwin-Williams

Application Process, Sherwin williams commercial credit application

Applying for the Sherwin-Williams Commercial Credit Application is a straightforward process. Businesses can follow these steps:

- Complete the online application form

- Provide supporting documentation, including financial statements and business licenses

- Submit the application for review

The required documentation may vary depending on the business’s size and financial profile. A Sherwin-Williams representative can assist with the application process and provide guidance on the specific requirements.

Credit Review and Approval

The credit review process typically takes 5-7 business days. Sherwin-Williams evaluates various factors, including:

- Business credit history

- Financial stability

- Projected cash flow

- Relationship with Sherwin-Williams

Upon approval, businesses receive a credit limit and payment terms tailored to their needs. The approval process is designed to ensure that businesses have the financial capacity to meet their credit obligations.

Terms and Conditions

The Sherwin-Williams Commercial Credit Application comes with specific terms and conditions. These include:

- Annual membership fee

- Variable interest rates based on the business’s credit profile

- Minimum monthly payments

- Late payment fees

It is essential for businesses to carefully review the terms and conditions before applying to ensure that they fully understand their obligations and financial responsibilities.

Benefits and Features

Using the Sherwin-Williams Commercial Credit Application offers several benefits and features:

- Convenient purchasing:Businesses can purchase paint and supplies on credit, eliminating the need for upfront payments.

- Extended payment terms:Flexible payment terms allow businesses to spread out their payments over a longer period, improving cash flow.

- Exclusive discounts:Commercial credit account holders receive exclusive discounts and promotions on paint and supplies.

- Simplified billing:Consolidated billing statements provide a clear and organized record of purchases.

- Online account management:Businesses can manage their account online, track purchases, and make payments conveniently.

Customer Support

Sherwin-Williams provides dedicated customer support to assist businesses with any inquiries or issues related to the Commercial Credit Application. Support channels include:

- Phone:1-800-474-3794

- Email:[email protected]

- Online chat:Available on the Sherwin-Williams website

Customer support representatives are available during regular business hours to provide prompt and personalized assistance.

Case Studies and Testimonials

Numerous businesses have successfully used the Sherwin-Williams Commercial Credit Application to manage their paint and supplies purchases. Case studies and testimonials highlight the positive experiences and outcomes achieved:

“The Sherwin-Williams Commercial Credit Application has been instrumental in helping us grow our business. The extended payment terms have improved our cash flow, and the exclusive discounts have saved us significant costs.”- ABC Painting, Inc.

Comparison with Competitors

The Sherwin-Williams Commercial Credit Application compares favorably with similar offerings from competitors. Unique advantages include:

- Strong industry partnerships:Sherwin-Williams has established partnerships with leading paint and supplies manufacturers, offering a wide selection of products and exclusive promotions.

- Dedicated customer support:Sherwin-Williams provides personalized support throughout the application and account management process.

- Flexible payment options:Businesses can choose from various payment options, including monthly payments, extended terms, and revolving credit.

Query Resolution

What are the eligibility criteria for the Sherwin-Williams Commercial Credit Application?

To be eligible, businesses must meet certain financial criteria, including a minimum annual revenue threshold and a strong credit history.

What is the application process for the Sherwin-Williams Commercial Credit Application?

The application process is straightforward and can be completed online or in-store. Businesses will need to provide basic financial information and documentation.

How long does it take to get approved for the Sherwin-Williams Commercial Credit Application?

The credit review process typically takes 5-7 business days. However, the turnaround time may vary depending on the complexity of the application.

What are the benefits of using the Sherwin-Williams Commercial Credit Application?

Benefits include extended payment terms, access to exclusive discounts and promotions, and simplified procurement processes.