Problem 5-5 analyzing transactions into debit and credit parts – Problem 5-5: Analyzing Transactions into Debit and Credit Parts is a fundamental concept in accounting that provides a structured approach to recording and analyzing financial transactions. This process forms the basis for accurate financial reporting and ensures the integrity of financial statements.

By understanding the principles of debit and credit analysis, individuals can effectively track the flow of economic resources within an organization, enabling informed decision-making and financial planning.

Definition of Transaction Analysis

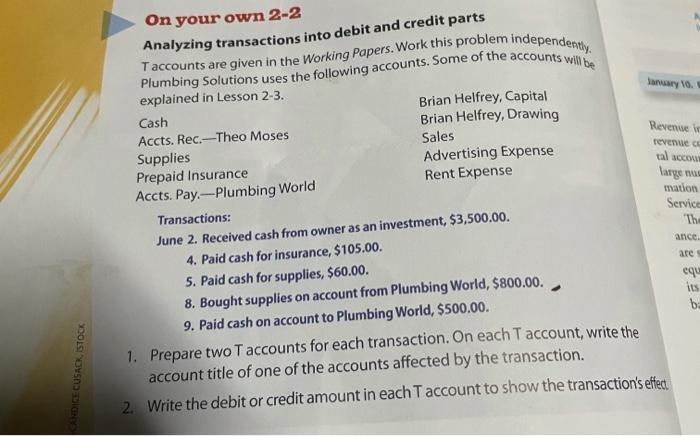

Transaction analysis is the process of breaking down a transaction into its individual debit and credit parts. This process helps to ensure that the transaction is recorded accurately and completely in the accounting system.

Identifying Transaction Components

To identify the key components of a transaction, follow these steps:

- Identify the accounts involved in the transaction.

- Determine the amount of the transaction.

- Determine the type of transaction.

Debits and credits are two sides of an accounting entry. A debit is an entry on the left side of an accounting equation, while a credit is an entry on the right side. Debits increase assets and expenses, and decrease liabilities, equity, and revenue.

Credits decrease assets and expenses, and increase liabilities, equity, and revenue.

Recording Transactions in Accounting System, Problem 5-5 analyzing transactions into debit and credit parts

To record a transaction in an accounting system, follow these steps:

- Identify the accounts involved in the transaction.

- Determine the amount of the transaction.

- Determine the type of transaction.

- Create a journal entry to record the transaction.

Here is an example of a transaction and how it is recorded using debits and credits:

Cash (debit) $100

Accounts Receivable (credit) $100

This transaction records the sale of goods or services on account. The debit to Cash increases the Cash account by $100. The credit to Accounts Receivable increases the Accounts Receivable account by $100.

Using Debit and Credit Rules

The following table summarizes the debit and credit rules for different types of accounts:

| Account Type | Debit | Credit |

|---|---|---|

| Assets | Increase | Decrease |

| Liabilities | Decrease | Increase |

| Equity | Decrease | Increase |

| Revenue | Increase | Decrease |

| Expenses | Decrease | Increase |

Balancing Transactions

Balancing transactions means that the total debits in a transaction equal the total credits. This ensures that the accounting equation (Assets = Liabilities + Equity) remains in balance.

Here are some examples of balanced and unbalanced transactions:

- Balanced transaction: Debit to Cash $100, Credit to Accounts Receivable $100.

- Unbalanced transaction: Debit to Cash $100, Credit to Accounts Payable $50.

To balance a transaction, you can use the following methods:

- Add a debit or credit to an existing account.

- Create a new account.

- Reverse the transaction.

Top FAQs: Problem 5-5 Analyzing Transactions Into Debit And Credit Parts

What is the purpose of transaction analysis?

Transaction analysis helps identify the effects of financial transactions on an organization’s financial position and performance.

How do I determine whether an account is debited or credited?

The debit and credit rules specify which accounts are debited or credited based on the type of transaction and the account classification (e.g., assets, liabilities, equity, revenue, expenses).

Why is balancing transactions important?

Balancing transactions ensures that the total debits equal the total credits, maintaining the accounting equation (Assets = Liabilities + Equity) and the integrity of financial statements.