Following are the issuances of stock transactions, a fundamental aspect of corporate finance, encompassing a diverse range of instruments and strategies employed by companies to raise capital and manage their financial structure. This guide delves into the intricacies of common stock, preferred stock, debt securities, warrants, and options, providing a comprehensive understanding of their characteristics, issuance processes, and implications.

Understanding the nuances of stock transactions is paramount for investors, analysts, and corporate decision-makers alike, as these transactions shape a company’s capital structure, influence its financial performance, and impact its overall risk profile.

Issuance of Common Stock

Common stock is a type of security that represents ownership in a company. When a company issues common stock, it is selling a portion of ownership to investors. In return for their investment, investors receive shares of stock, which represent a claim on the company’s assets and earnings.

The process of issuing common stock is typically overseen by an investment bank. The investment bank will work with the company to determine the number of shares to be issued, the price of the shares, and the terms of the offering.

Once the terms of the offering have been determined, the investment bank will market the shares to potential investors.

Advantages of Issuing Common Stock

- Raises capital for the company

- Can be used to acquire other companies

- Provides investors with a potential return on their investment

Disadvantages of Issuing Common Stock

- Dilutes the ownership of existing shareholders

- Can be expensive to issue

- Can be difficult to find investors who are willing to buy the shares

Issuance of Preferred Stock: Following Are The Issuances Of Stock Transactions

Preferred stock is a type of security that has some characteristics of both common stock and debt. Like common stock, preferred stock represents ownership in a company. However, preferred stock typically has a higher claim on the company’s assets and earnings than common stock.

In addition, preferred stock typically pays a fixed dividend, which makes it more attractive to investors who are looking for a steady income stream.

The process of issuing preferred stock is similar to the process of issuing common stock. However, there are some additional considerations that must be taken into account when issuing preferred stock. For example, the company must determine the dividend rate, the maturity date, and the call features of the preferred stock.

Advantages of Issuing Preferred Stock

- Raises capital for the company

- Provides investors with a steady income stream

- Can be used to acquire other companies

Disadvantages of Issuing Preferred Stock

- Dilutes the ownership of existing shareholders

- Can be expensive to issue

- Can be difficult to find investors who are willing to buy the shares

Issuance of Debt Securities

Debt securities are a type of security that represents a loan from an investor to a company. When a company issues debt securities, it is borrowing money from investors. In return for their investment, investors receive a bond, which represents a promise from the company to repay the loan with interest.

The process of issuing debt securities is typically overseen by an investment bank. The investment bank will work with the company to determine the amount of money to be borrowed, the interest rate, and the maturity date of the debt securities.

Once the terms of the offering have been determined, the investment bank will market the debt securities to potential investors.

Advantages of Issuing Debt Securities, Following are the issuances of stock transactions

- Raises capital for the company

- Can be used to finance a variety of projects

- Can be used to improve the company’s credit rating

Disadvantages of Issuing Debt Securities

- The company must repay the loan with interest

- The company may be required to provide collateral for the loan

- The company may be restricted in its ability to take on additional debt

Issuance of Warrants and Options

Warrants and options are two types of securities that give the holder the right to buy a certain number of shares of stock at a specified price. Warrants are typically issued by companies as a way to raise capital. Options are typically issued by companies as a way to reward employees or to attract new investors.

The process of issuing warrants and options is similar to the process of issuing common stock. However, there are some additional considerations that must be taken into account when issuing warrants and options. For example, the company must determine the number of warrants or options to be issued, the exercise price, and the expiration date.

Advantages of Issuing Warrants and Options

- Can be used to raise capital for the company

- Can be used to reward employees or to attract new investors

- Can be used to hedge against the risk of a decline in the stock price

Disadvantages of Issuing Warrants and Options

- Can dilute the ownership of existing shareholders

- Can be expensive to issue

- Can be difficult to find investors who are willing to buy the warrants or options

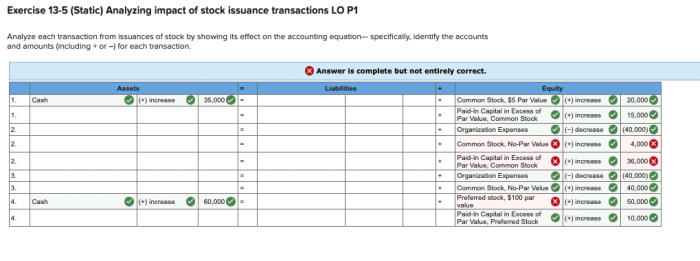

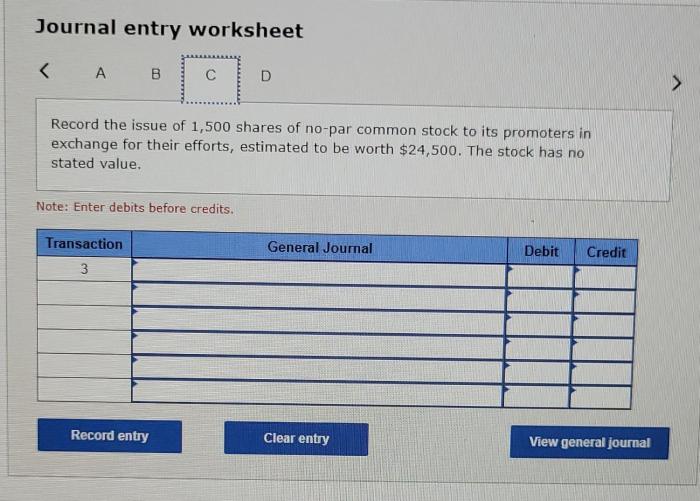

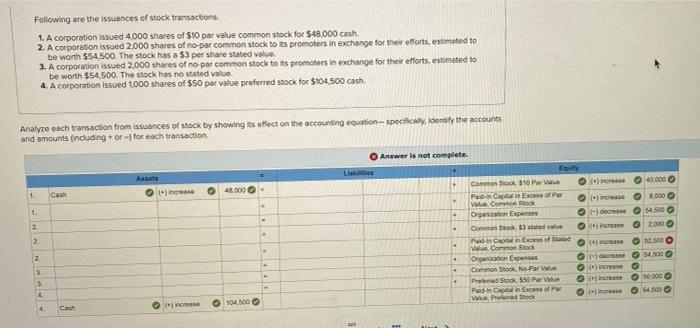

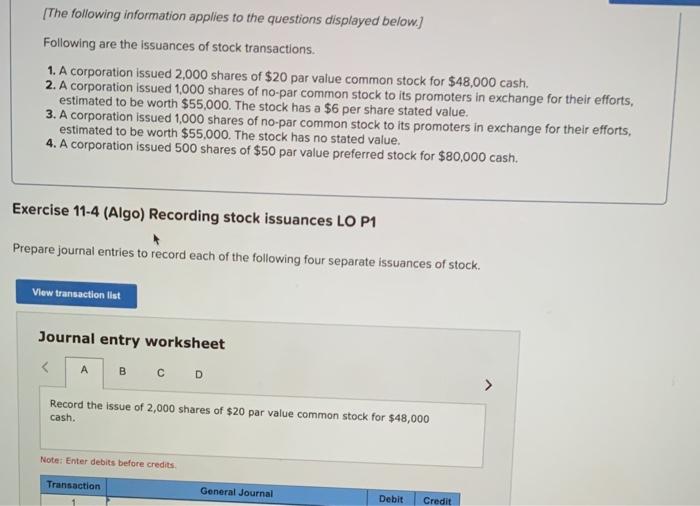

Accounting for Stock Transactions

Stock transactions are recorded in the financial statements in accordance with the principles of accrual accounting. This means that stock transactions are recorded when they occur, regardless of when the cash is received or paid.

The following are the basic accounting principles for recording stock transactions:

- Common stock is recorded at its par value.

- Preferred stock is recorded at its stated value.

- Warrants and options are recorded at their fair value.

- Stock dividends are recorded at the fair value of the shares distributed.

- Stock splits are recorded as a reduction in the number of shares outstanding.

FAQ Corner

What is the purpose of issuing common stock?

Issuing common stock allows companies to raise capital by selling ownership shares to investors, thereby increasing the number of outstanding shares and diluting existing shareholders’ ownership.

What are the advantages of issuing preferred stock?

Preferred stock offers investors a hybrid security with features of both common stock and debt, providing regular dividend payments and a higher claim on assets in the event of liquidation.

What are the different types of debt securities?

Debt securities encompass a wide range of instruments, including bonds, notes, and debentures, each with varying maturities, interest rates, and security features.

What is the purpose of issuing warrants and options?

Warrants and options grant investors the right, but not the obligation, to purchase a specified number of shares at a predetermined price within a specified period.

How are stock transactions recorded in financial statements?

Stock transactions are recorded in the financial statements in accordance with specific accounting principles and procedures, impacting the balance sheet, income statement, and statement of cash flows.