The T47 Residential Real Property Affidavit is a crucial document that plays a pivotal role in real estate transactions and property ownership. This affidavit serves as a comprehensive record of property details, exemptions, and ownership information, offering numerous benefits and legal implications.

In this article, we will delve into the significance, elements, preparation, and uses of the T47 Residential Real Property Affidavit, providing a comprehensive understanding of its importance in the real estate realm.

1. T47 Residential Real Property Affidavit Overview

A T47 Residential Real Property Affidavit is a legal document used in the United States to provide evidence of ownership and claim exemptions for residential properties. It is a sworn statement that provides detailed information about the property, including its description, ownership history, and any exemptions claimed.

The T47 Affidavit is an essential part of the property tax assessment process. By filing a T47 Affidavit, homeowners can reduce their property taxes by claiming eligible exemptions, such as the homestead exemption or the senior citizen exemption.

Parties Involved in the T47 Process, T47 residential real property affidavit

- Homeowner:The individual or entity that owns the residential property and is responsible for filing the T47 Affidavit.

- Assessor:The local government official responsible for assessing the value of properties and collecting property taxes.

- Tax Collector:The local government official responsible for collecting property taxes.

2. Elements of a T47 Residential Real Property Affidavit

A T47 Residential Real Property Affidavit typically includes the following sections:

- Property Description:A detailed description of the property, including its address, legal description, and any improvements.

- Ownership Details:Information about the owner(s) of the property, including their names, addresses, and ownership interests.

- Exemptions Claimed:A list of any exemptions that the homeowner is claiming, along with supporting documentation.

- Signature and Notary:The homeowner’s signature and the signature of a notary public, who verifies the homeowner’s identity and the authenticity of the affidavit.

3. Preparation and Submission of a T47 Residential Real Property Affidavit

To prepare and submit a T47 Residential Real Property Affidavit, homeowners should follow these steps:

- Obtain the T47 Form:The T47 form can be obtained from the local assessor’s office or the county recorder’s office.

- Complete the Form:Fill out the T47 form accurately and completely, providing all required information.

- Gather Supporting Documentation:Gather any supporting documentation required to support the exemptions claimed, such as proof of residency or age.

- Sign and Notarize the Form:Sign the T47 form in the presence of a notary public and have the notary public notarize the signature.

- Submit the Form:Submit the completed T47 form to the local assessor’s office by the deadline.

- Filing the T47 Affidavit late.

- Providing false or misleading information on the T47 Affidavit.

- Failing to provide supporting documentation for claimed exemptions.

- Evidence of Ownership:A T47 Affidavit can serve as evidence of ownership of a residential property.

- Property Tax Reduction:By claiming eligible exemptions on a T47 Affidavit, homeowners can reduce their property taxes.

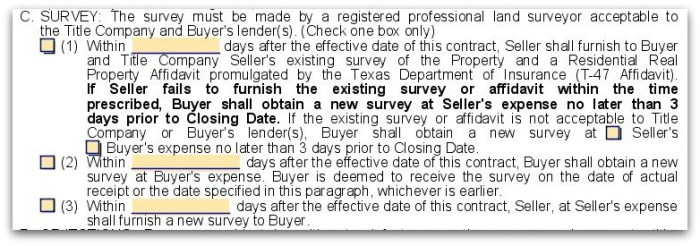

- Streamlined Real Estate Transactions:A T47 Affidavit can streamline the process of buying or selling a residential property by providing evidence of ownership and exemptions.

- Homestead Exemption:This exemption is available to homeowners who occupy their property as their primary residence.

- Senior Citizen Exemption:This exemption is available to homeowners who are 65 years of age or older.

- Disability Exemption:This exemption is available to homeowners who are disabled.

- False or Misleading Information:Providing false or misleading information on a T47 Affidavit is a crime and can result in penalties, including fines and imprisonment.

- Tax Fraud:Claiming ineligible exemptions on a T47 Affidavit is a form of tax fraud and can result in penalties, including back taxes and interest.

Common Mistakes to Avoid:

4. Uses and Benefits of a T47 Residential Real Property Affidavit

A T47 Residential Real Property Affidavit provides several benefits for homeowners, including:

5. Exemptions and Exclusions in a T47 Residential Real Property Affidavit

There are several exemptions available under a T47 Residential Real Property Affidavit, including:

To claim an exemption, homeowners must meet the eligibility criteria and provide supporting documentation.

6. Legal Implications and Consequences of a T47 Residential Real Property Affidavit

Submitting a T47 Residential Real Property Affidavit has several legal implications, including:

It is important to seek professional advice from an attorney or accountant if you have any questions about the legal implications of a T47 Residential Real Property Affidavit.

Helpful Answers

What is the purpose of a T47 Residential Real Property Affidavit?

The T47 Residential Real Property Affidavit is a legal document that provides a detailed record of property ownership, exemptions, and other relevant information. It is used to claim exemptions from property taxes and to establish proof of ownership.

Who can file a T47 Residential Real Property Affidavit?

Homeowners and property owners can file a T47 Affidavit to claim exemptions and provide information about their property.

What information is required in a T47 Residential Real Property Affidavit?

The affidavit includes information such as property description, ownership details, exemptions claimed, and supporting documentation.

What are the benefits of filing a T47 Residential Real Property Affidavit?

Filing a T47 Affidavit can help reduce property taxes, provide evidence of ownership, and streamline real estate transactions.

What are the potential consequences of providing false or misleading information on a T47 Residential Real Property Affidavit?

Providing false or misleading information on a T47 Affidavit can result in penalties, including fines and imprisonment.